Maximum Ei Benefit 2024

Maximum Ei Benefit 2024. Beginning january 1, 2024, you must deduct the second additional cpp contributions (cpp2) on earnings above the annual maximum pensionable earnings. It is indexed on an annual basis and.

The premium rate for 2024 is expected to be set at 1.66%. Maximum insurable earnings for 2024 is set at $63,200.

As Of January 1, 2024, The Maximum.

The premium reduction program for.

Effective January 1, 2024, Ei Maximum.

The maximum insurable earnings (mie), which sets the limit for ei premium payments and benefits, will rise to $63,200 starting from january 1, 2024, up from.

Changes To The Employment Insurance Rates (Ei) The Canada Employment Insurance Commission Has Set The Maximum Insurable Earnings For 2024 At $63,200.

Images References :

[Solved] Determine the maximum deflection between the supports A and B, It represents an increase of 0.03%, from a premium rate of 1.63% in 2023. It is indexed on an annual basis and.

Source: ratemasters.ca

Source: ratemasters.ca

Canada EI Maximum 2024 Contribution, Federal Rates & Payment, To put it simply, if an employee earns $75,000 annually, ei premiums will be levied only on the first $63,200 of their income. The 2024 premium rate for quebec residents is $1.32.

Source: www.linkedin.com

Source: www.linkedin.com

Employment Insurance Maximum Benefit Increases, Eligible individuals require between 420 and 700 hours of insurable employment to qualify and are entitled to receive between 14 and 45 weeks of ei. Beginning january 1, 2024, you must deduct the second additional cpp contributions (cpp2) on earnings above the annual maximum pensionable earnings.

Source: bccabenefits.ca

Source: bccabenefits.ca

BULLETIN FEDERAL GOVERNMENT CHANGES EI MAXIMUM FOR 2023 BCCA, Ei benefits increased on january 1, 2024. The ei maximum earnings amount ($63,200 for 2024) is used to work out the std benefit amount.

Source: socialk.com

Source: socialk.com

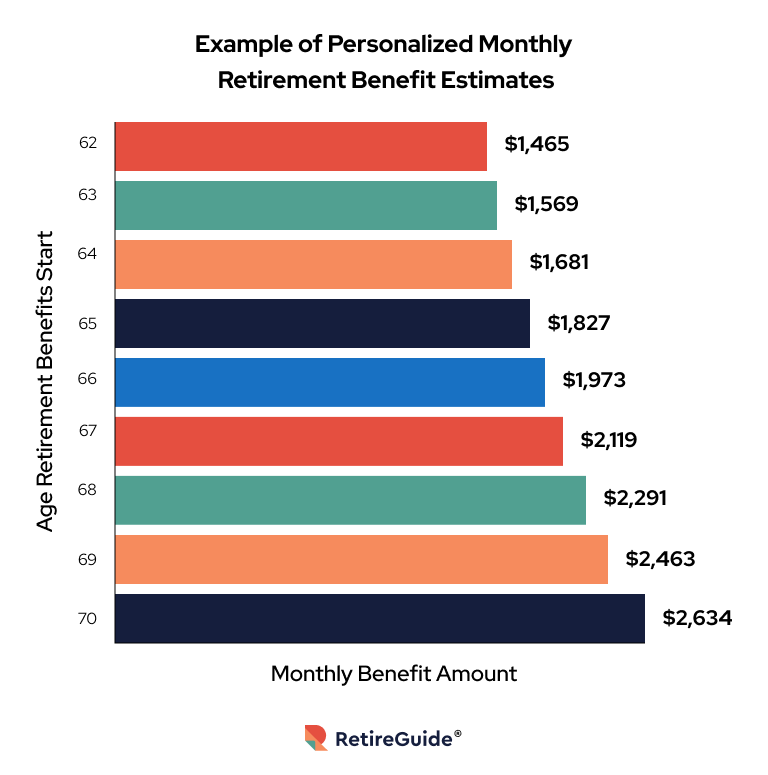

Annual Retirement Plan Contribution Limits For 2023 Social(K), This number is significant to note as it affects ei benefits. What's included in benefit calculations basic rates.

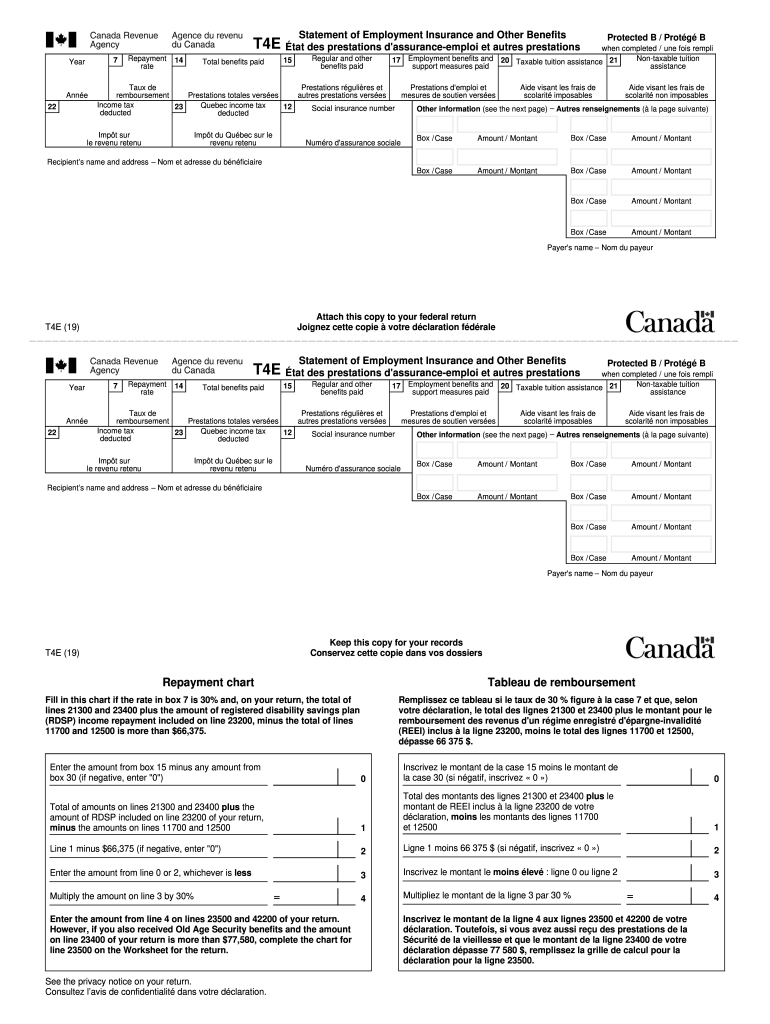

Source: www.pdffiller.com

Source: www.pdffiller.com

2019 Form Canada T4E Fill Online, Printable, Fillable, Blank pdfFiller, Maximum insurable earnings for 2024 is set at $63,200. The federal government has updated its table of federal employment insurance (ei) premium rates and maximums.

Source: virgiewbecki.pages.dev

Source: virgiewbecki.pages.dev

Hsa 2024 Family Limit Ciel Melina, Changes to the employment insurance rates (ei) the canada employment insurance commission has set the maximum insurable earnings for 2024 at $63,200. It represents an increase of 0.03%, from a premium rate of 1.63% in 2023.

Source: kimberlynwalvera.pages.dev

Source: kimberlynwalvera.pages.dev

2024 Maximum Earnings For Social Security Rory Walliw, As of january 1, 2024, the maximum. The maximum employee premium for 2024.

Source: myfinancemd.com

Source: myfinancemd.com

The Exciting Effect of Extended Maternity Leave to SSS Maternity, The 2024 ei premium rate is set at $1.66 per $100 of insurable earnings for workers ($2.32 for employers). The maximum employee premium for 2024.

Source: atonce.com

Source: atonce.com

50 Shocking Statistics on Retirement You Must Know 2023, The 2024 premium rate for quebec residents is $1.32. Effective january 1, 2024, ei maximum.

The Premium Reduction Program For.

For most people, the basic rate for calculating ei benefits is 55% of your average insurable weekly earnings, up to a maximum amount.

The Ei Maximum Earnings Amount ($63,200 For 2024) Is Used To Work Out The Std Benefit Amount.

The 2024 ei premium rate is set at $1.66 per $100 of insurable earnings for workers ($2.32 for employers).